Book by Ramit Sethi.

Having decided to venture into the intimidating world of personal finance, I was looking for a book that doesn’t overwhelm me with complicated theories and concepts and Ramit Sethi’s book seemed right up that alley. Although the reviews indicated that his breezy and irreverent tone were a bit of a put off, I decided to give it a shot.

Couple of things first before we get to the crux of the book itself. The book is written in 2009, which means that some of the suggestions might feel outdated. But then again, most of his advice is timeless (except for the fact that it has no mention of bitcoins!!). Secondly, the book is geared towards readers in their early 20s stepping into the “real” world with no clue on how to manage their money. So if you are a 40 year personal finance veteran, I would suggest you to skip it.

As for me, I still lack a good personal finance 101 and hence, I decided to go ahead with it. Some of the key learnings from the book that stood out to me were:

Create Conscious Spending Plan:

“Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t”

I have had a long complicated relationship with money, often being unable to draw a line between what’s okay to spend on and whats not. Spending, as a whole, isn’t a bad thing as long as you do it on the things that matter to you and bring you joy- it can be shoes for one, travel for another. Instead of creating a budget geared towards optimizing savings, instead create a spending plan to identify your major expenditure. As a point of reference, Ramit’s advise is to allocate 50-60% of your salary on fixed costs like rent, grocery, utilities etc, 10% on investments like 401k, stocks, 5-10% on savings and use the remaining 20-35% on guilt-free spending. I liked the emphasis on “guilt free” spending because if you really want something and value it, then having guilt associated with it is no fun.

Buy/Sell vs Buy/Hold:

This book was written in a time way before “meme” stocks like gamestop and dogecoin existed, and relates more to the 2008 financial crisis than to the market fluctuations of the 2020 Covid era. With stocks like TSLA reaching unfathomable numbers, it is difficult to resist getting into a buy-and-sell rhythm at the sight of the slightest profit. But Ramit advises against it, and instead suggests playing the long term game. Timing the market is a difficult game to be in, and one in which success is never a guarantee. Therefore, invest regularly over a period of time and let time and the market work its charm to get you the profits. Not only does it lead to better yields, but you also saves you on capital gain tax as opposed to short term investments.

A Diversified Portfolio:

As with the classic proverb, don’t put all your eggs in one basket- diversify your portfolio to include different forms of investment.

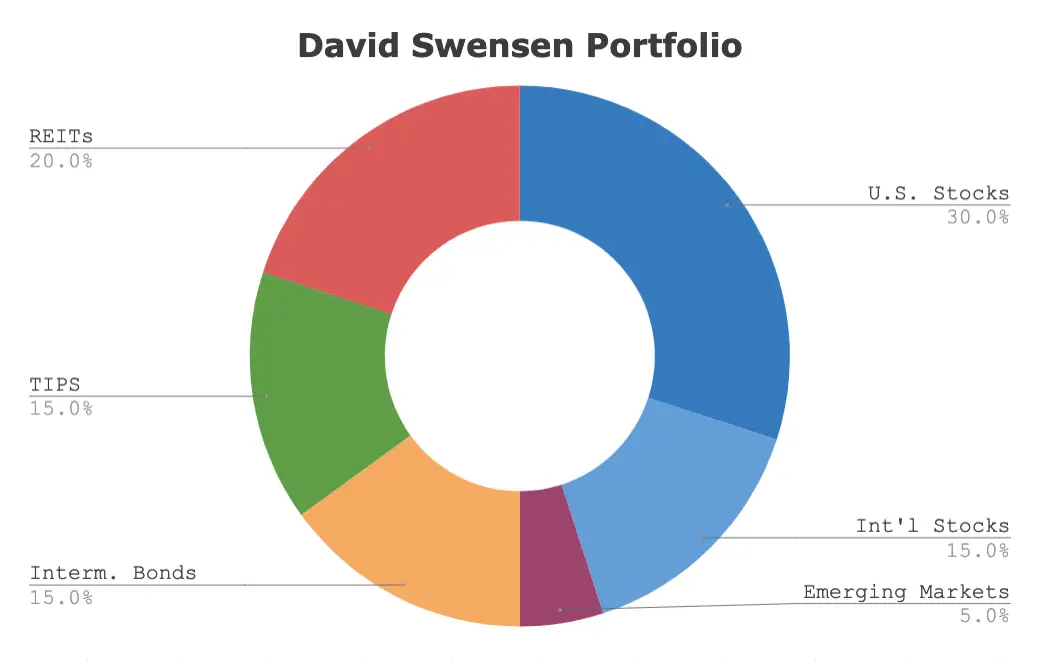

As a template, Ramit refers to the “Swensen Model of Asset Allocation” which advises you to put your assets as per the chart below:

By doing so, you do not run the risk of extreme highs and lows when one industry performs better than another. Neither are you constantly fretting over your investments when you have some of your assets in reliable albeit low yielding options like government bonds while also profiting from high-risk stocks.

Convenience over Autonomy:

Or rather lifecycle funds over index funds?

Choosing one over the other boils down to how much autonomy do you wish to have in your investments. Lifecycle funds (aka target-date funds) are the epitome of convenience- it comprises of a well balanced portfolio that readjusts periodically to account for any fluctuations in the market. On the other hand, index funds offer you greater autonomy with the option of building your own portfolio at a much lower expense ratio but with the additional work of balancing it out. Target date funds are tailored based on your risk appetite and tend to get increasingly risk-averse closer to your retirement age.

In the hindsight, a lot of the advice offered in the book may seem obvious- of course you should plan for big expenses like buying a house, of course you should try to maximize your earnings by negotiating, and of course you should start early when it comes to investing and leverage the power of compound interest. But then again, even though they might be obvious, it’s easier said than done and once in a while its good to remind yourself that in personal finance, like most other things, it’s good to have a plan and follow it through.

Leave a comment